How Can MGAs Drive Superior Customer Experience and Enhance Retention

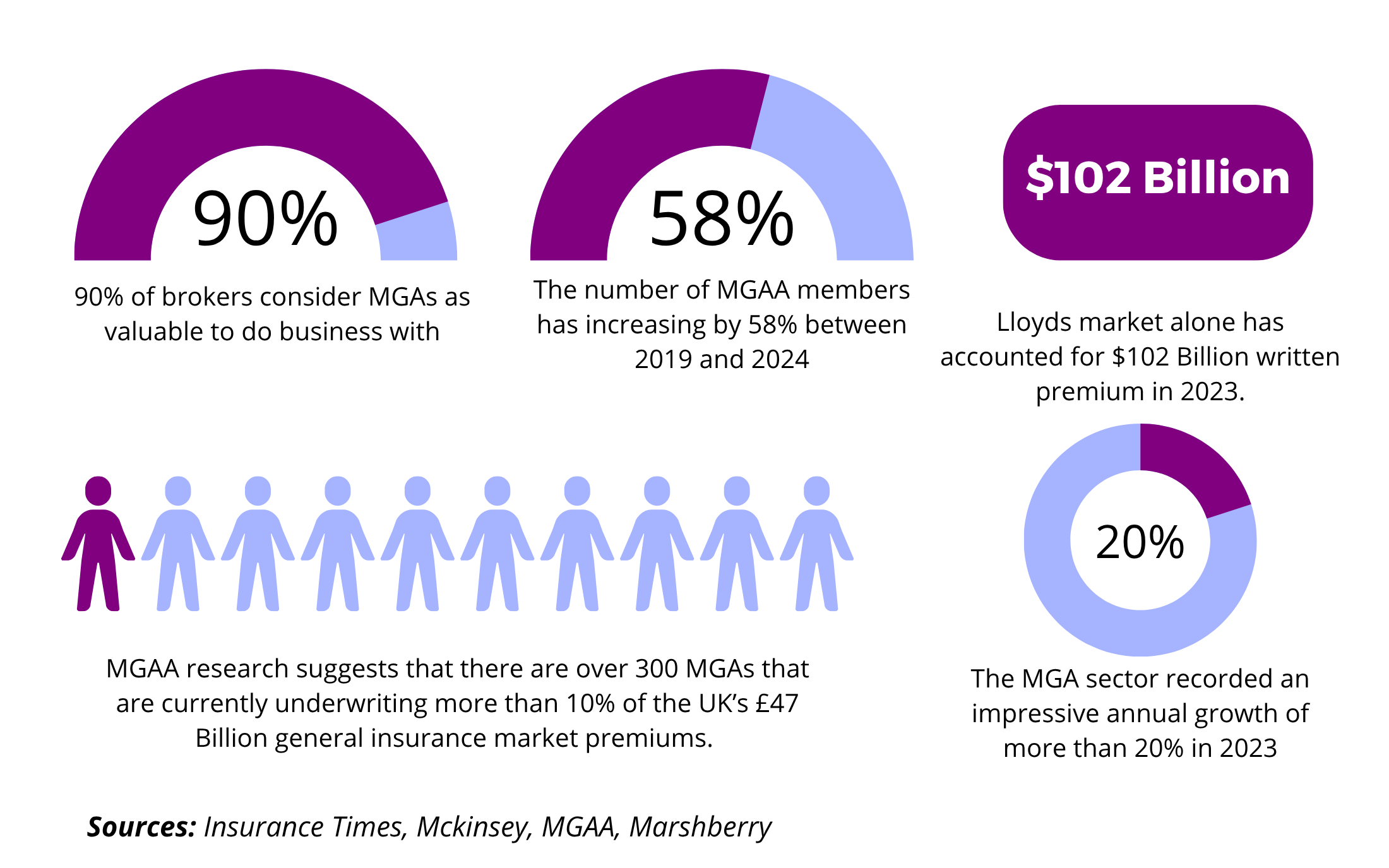

MGAs play an irreplaceable role in the insurance sector, and while it’s crucial for them to be on top of all their regulatory and compliance duties, they also need to ensure seamless customer experience (CX) and retention. At the end of the day, customers should always be at the heart of every business decision because without them, no firm would survive. In addition, MGAs need to ensure they’re always treating their clients fairly. According to Forrester, 41% of customer-obsessed firms achieved at least 10% revenue growth in 2023, compared to only 10% of less mature firms...