Having a successful compliance strategy and department that stays ahead of all compliance requirements, laws and updates starts above all with a proactive compliance culture – One that is shared among all seniority levels within a firm.

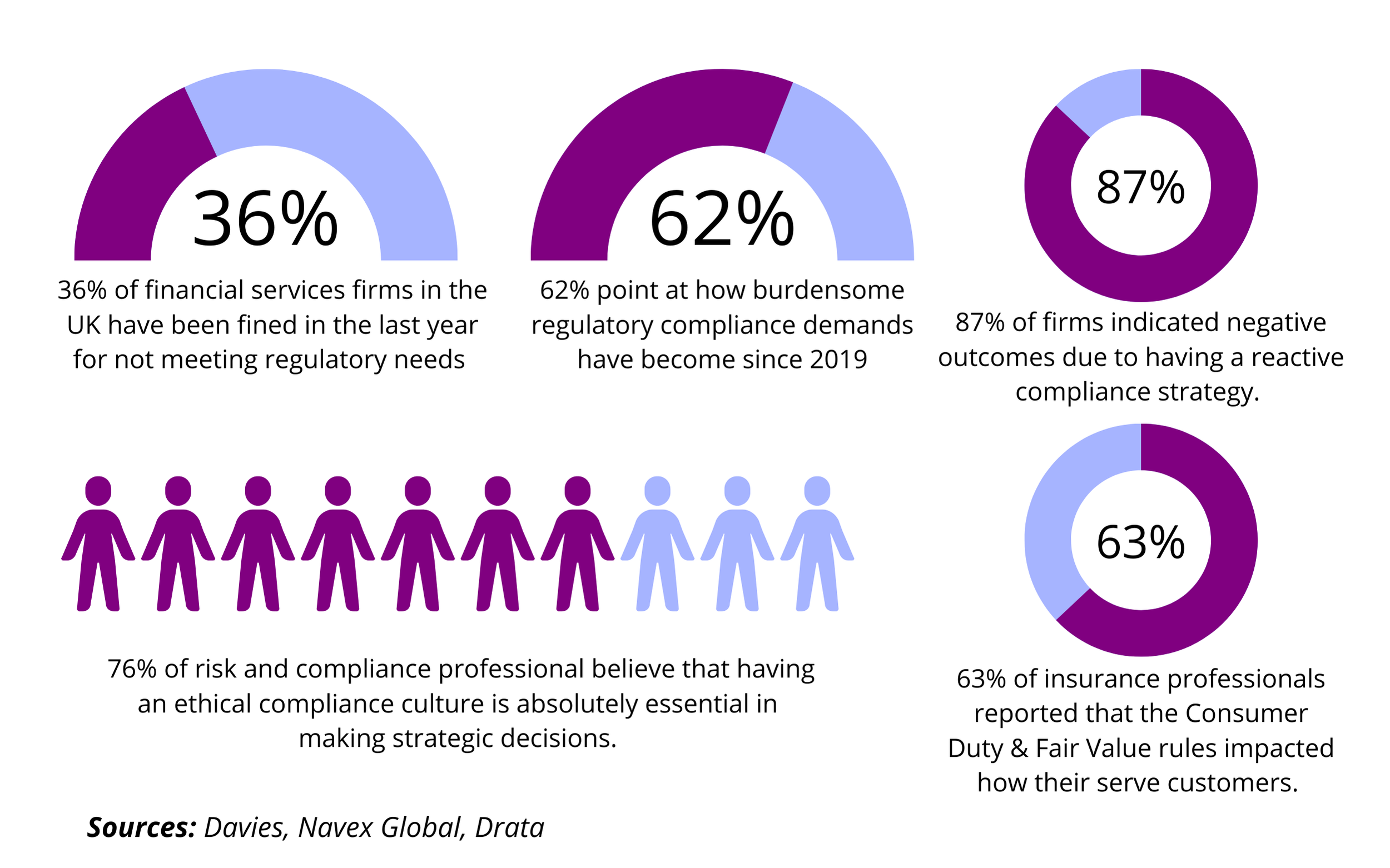

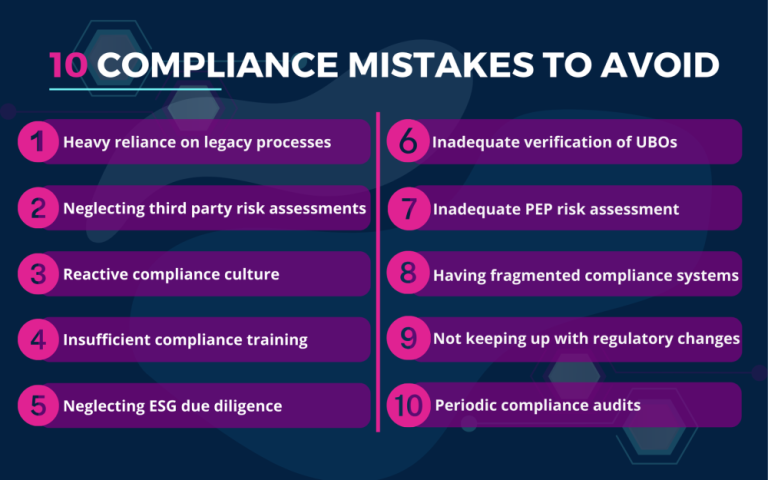

Unfortunately, many businesses neglect their regulatory duties and tend to react rather than proactively prepare and strategize for unexpected changes.

Most importantly, firms naturally lean towards prioritising revenue and commissions rather than foster a proactive compliance culture across their organisations, leading to inconsistent compliance processes, missed regulatory deadlines, financial penalties and even reputational damage.

As Steve Folkard said in our latest webinar: “Leaders have the responsibility not to think of compliance as something which needs to separately from the way you run the business”. The key is to ingrain a proactive compliance culture into a business’s core values, enabling compliance leaders and insurance professionals to operate with top-notch regulatory values in mind.