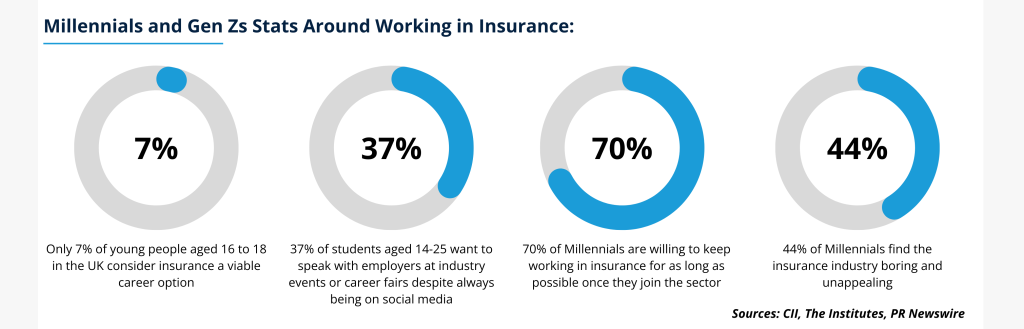

Due to COVID-19 and other economic and political upheavals, the majority of workers’ views on the workplace have shifted. Today, employees value time with family, work and life balance, and flexible hours – but the most important one that has become a must in many job seekers’ requirements is Hybrid working. Deloitte has discovered that 61% and 55% of Gen Zers and Millennials respectively have hybrid or remote work patterns as of 2023, compared to 36% and 32% before COVID-19. Also, a whopping 59% of millennials and 54% of Gen Zers believe hybrid working has a positive impact on their mental health.

Insurance is regarded as strict and inflexible, while in reality, many insurance firms are adapting to these changing demands and are introducing a variety of flexible perks. This means that it is up to the industry leaders to clarify the opportunities and the flexibility that come with working at the heart of the insurance market. Insurance’s company culture is also believed to be stricter with a focus on a “suit and tie” dress code which discourages younger generations that prefer a more relaxed environment.