Pushing Positive Change: Women in Insurance Panel Event

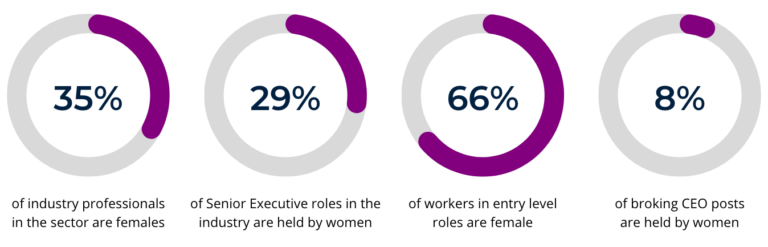

Panel discussion addressing the challenges facing women in the market around representation, gender pay gap, discrimination and unconscious bias and how we can promote positive change to action fairer and equal opportunities for women in insurance.